Olympic Medical Center: Stabilizing the Patient, Now the Hard Work of Rehabilitation Begins

A veteran financial analyst offers his perspective on OMC’s financial position and the hard choices ahead.

Editor’s Note:

This letter to the Port Angeles City Council comes from Steven C. Pelayo, CFA, a friend of Clallam County Solutions and a seasoned investment professional with more than two decades of experience in global financial markets. Now Managing Director at The Blueshirt Group, Steven has advised CEOs and CFOs of leading technology companies across the U.S. and Asia and earned industry recognition from Bloomberg, the Wall Street Journal, and others for his analytical insight.

Steven also contributed extensively to our recent feature, OMC at a Crossroads: What’s Broken—and What’s Next?. This letter serves as a thoughtful follow-up, offering his independent, data-informed perspective on the financial realities facing Olympic Medical Center and our community.

Executive Summary

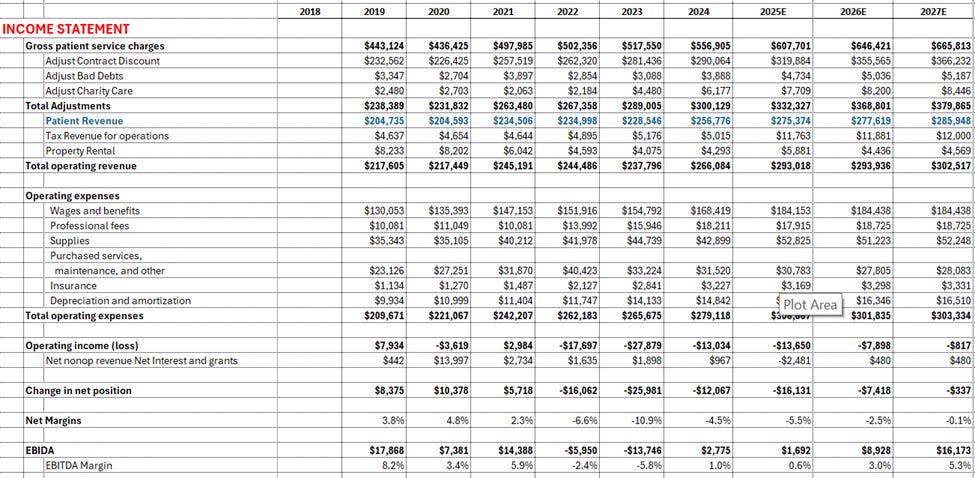

Olympic Medical Center (OMC) has endured three difficult years marked by falling margins, inaccurate budgeting, and a steep decline in cash reserves—from more than $100 million in 2020 to just $21 million at the end of 2024. The hospital’s heavy reliance on Medicare and Medicaid (84% of gross revenue) has kept patient revenue at less than half of billed charges, leaving little room for error as expenses climbed. Despite these headwinds, OMC’s new interim leadership appears to be stabilizing operations, restoring financial discipline, and creating a culture of accountability grounded in measurable performance metrics.

The 2025–2026 budgets reflect this shift: capital spending has been cut and accounts payable stretched to preserve cash, revenue forecasts seem conservative to me, and early signs of improvement are emerging, including positive EBIDA margins in recent months. Operating losses will persist for now, but operating cash flow could turn positive as receivables are collected, while the other areas of cash use such as debt service remains steady, and capital spending remains constrained. Beyond cash preservation, the focus has turned toward efficiency—driving productive hours per patient day and per wRVU, improving billing accuracy, and tightening departmental management. OMC is not out of the woods, but it is finally moving from crisis control to operational stabilization, with leadership emphasizing what can be controlled locally rather than blaming external factors.

A Fresh Look at OMC’s Financial Picture

Given its massive local presence and impact - and simply because I am a data nerd that is focused on the economic health of our community - I spent a few hours this week building a financial model for Olympic Medical Center. As a Chartered Financial Analyst, I’m accustomed to modeling publicly traded private companies in the tech sector, but this is the first time I’ve applied that framework to a public hospital. The business model is unlike anything I’ve studied before: actual patient revenue is far below gross charges due to the hospital’s payor mix and government reimbursement rates, and the accounting treatment of tax levies as revenue adds another layer of complexity.

I’ve now built a full income statement, balance sheet, and cash flow forecast through 2026 based on the recently released draft budget, and have even begun outlining what a sustainable 2027 model might look like. Yesterday’s management update helped fill in several gaps, offering new clarity into how leadership is tackling OMC’s liquidity pressures and operational inefficiencies.

Setting the Context

OMC operates 67 available beds and handles roughly 4,000 admissions per year. Its clinics account for approximately 150,000 annual visits, the emergency room treats around 27,000 patients, and home-health operations add another 40,000 visits. The hospital employs about 1,400 full-time staff, making it Clallam County’s largest employer.

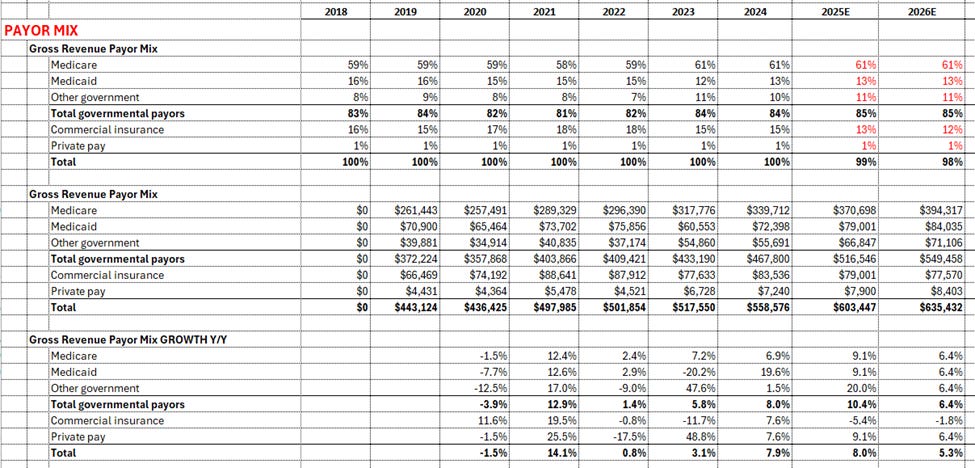

Because OMC does not publish detailed service-line financials, my analysis focuses on consolidated results. In 2024, GROSS patient revenue totaled $556 million, yet because Medicare and Medicaid represented 84% of the total payor mix—with Medicare alone accounting for roughly 61%—ACTUAL “Patient Revenue” fell to $256 million, or 46% of billed charges. Including tax levies and property-related income, total operating revenue reached $266 million. This extreme gap between billed and collected revenue is one of the defining factors of “known unknowns” in OMC’s business model.

Looking Back: How We Got Here

To understand the current situation, it’s important to look at how the hospital arrived here. Since 2019, patient revenue has grown at a compound rate of 4–5% annually, though the path has been uneven. In 2021, post-pandemic volumes rebounded sharply, with nearly 15% year-over-year growth. But by 2022 and 2023, revenue flattened while expenses continued to rise.

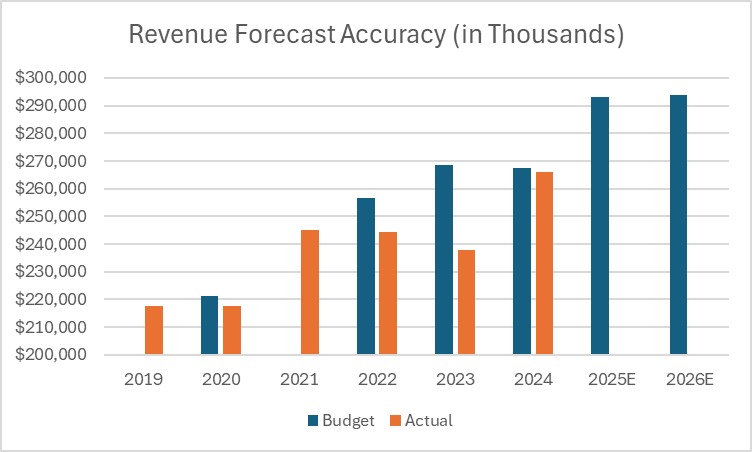

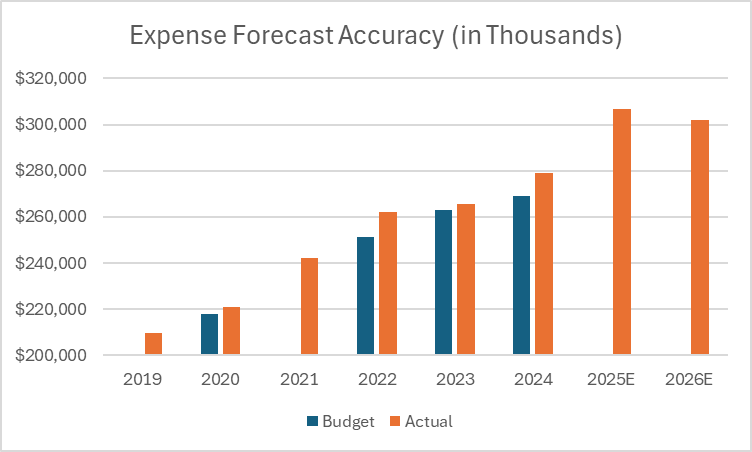

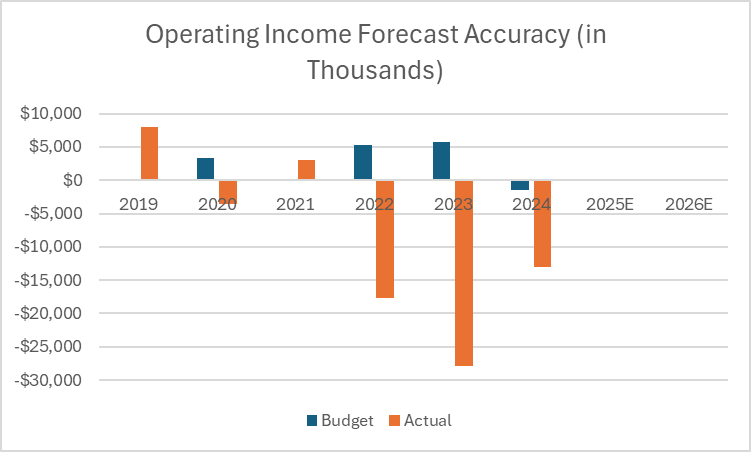

Even more concerning was how consistently the hospital missed its own forecasts. In 2022, OMC budgeted for $256 million in operating revenue but ended the year $12 million short; expenses were $11 million higher than planned. In 2023, the pattern worsened: a $268 million operating revenue target missed by $31 million, with expenses again exceeding budget. These miscalculations produced operating losses of -$18 million in 2022 and -$28 million in 2023. Including non-operating income, net margins fell from a steady 2–5% in earlier years to -6.6% in 2022 and -10.9% in 2023.

The result was a double blow—lower revenue and higher costs—compounded by weak forecasting. It’s no surprise that community confidence eroded, but equally clear that management was flying blind without accurate financial modeling.

2024: Modest Progress but Still in the Red

Last year offered signs of improvement, even if profitability remained elusive. Actual “Patient Revenue” rose 12.4%, roughly matching the original budget, while expenses grew 5%. Despite the revenue rebound, expenses still ran $10 million higher than planned producing an operating margin of -4.5% and a loss of roughly $13 million. This loss was about half the amount compared to the prior year. The financial bleeding had not stopped, but it has at least begun to coagulate (sorry, I could resist the pun).

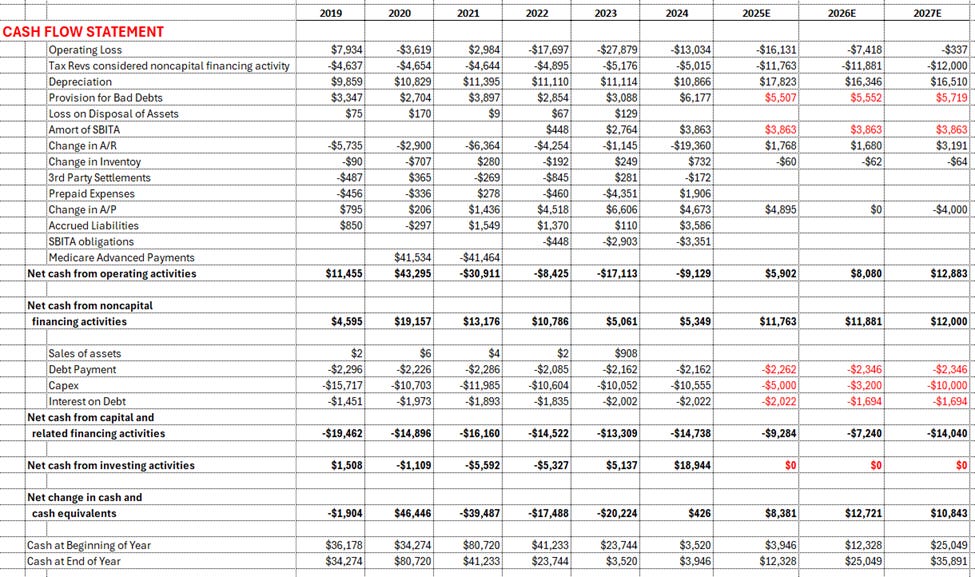

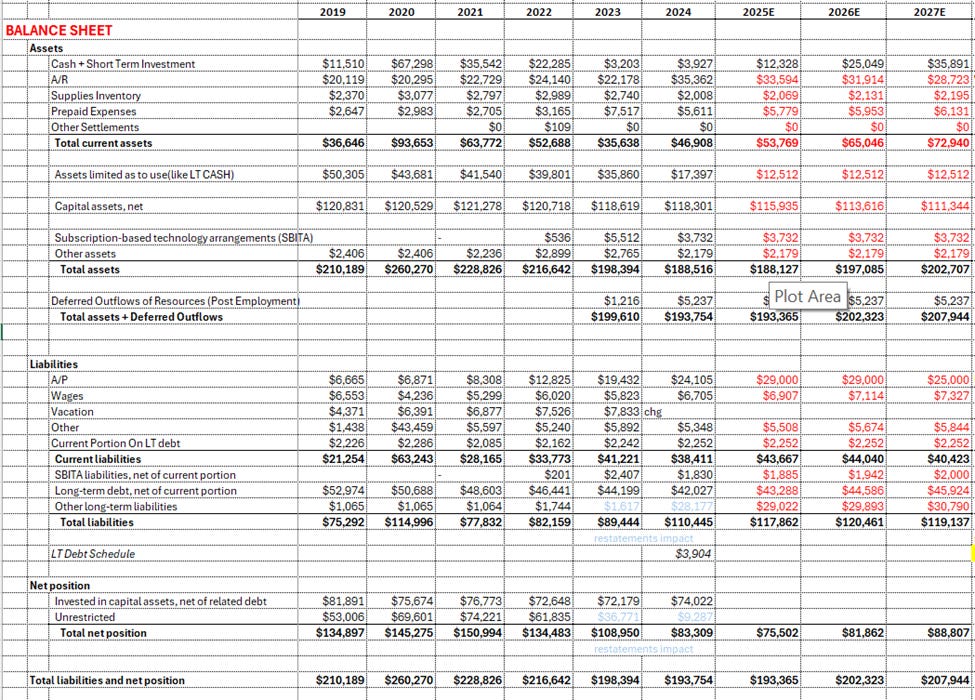

Cash flow remained strained. Reported operating cash flow was negative (-$9 million), the fourth consecutive year of a negative result (2022 was -$8 million and 2023 was -$17 million). Capital expenditures over the past year remained steady and averaged about $10-12 million annually. Including debt service (annually ~$2 million in principal and $2 million in interest costs), ending cash and investments dropped from more than $100 million in 2020 to $83 million in 2021, then fell by roughly $20 million per year to $21 million at the end of 2024. At that pace, insolvency would have been only a few quarters away without intervention.

2025–2026: Stabilization and a Shift in Mindset

Over the past couple of weeks (including an update yesterday), the interim CEO and CFO presented a pragmatic plan for the next two years. For 2025, they project Patient Revenue of $275 million (+7%) and total operating revenue of $293 million (+10%). Even so, the hospital expects another operating loss of around -$16 million. The key difference this time is that management is budgeting to preserve cash rather than overshoot it.

Capital spending has been cut in half to $5 million, and payables are being stretched by another $5 million—a short-term tactic that improves liquidity. The CFO relies on a simplified measure called EBIDA (earnings before interest, depreciation, and amortization), which adds back about $17 million in non-cash depreciation to operating income. His quick rule of thumb is that if OMC’s losses stay below $17 million, the hospital can maintain positive operating cash flow.

Initially, I worried this strategy was masking a deeper liquidity problem. But upon reviewing a draft of the 2024 cash flow statement, I saw that the change in accounts receivable grew by $19 million, which artificially depressed last year’s operating cash flow. If those receivables are slowly collected, I believe ending 2025 cash on hand could actually rise by $3–4 million, even as accounting losses persist.

The 2026 forecast looks incrementally better, with a projected operating loss of -$7.4 million. Adding back the non cash depreciation leave EBIDA of $9 million and a +3% EBIDA margin. Combined with still lower capital spending of $3.2 million and assuming continued stretched payables and improved collections, cash reserves could again rise by a $5-10 million dollars (and perhaps a bit more). In short, OMC appears to have transitioned from freefall to stabilization—buying precious time for deeper structural improvements.

What We Heard from the CFO and CEO

At this week’s finance meeting, the CFO reported that OMC ended September with 28 days of cash on hand, compared to 29 days at the end of 2024—essentially flat, which in the current environment qualifies as progress. EBIDA margins were positive at 2% for the month of September, suggesting some early traction.

The other notes I wrote down were:

Emergency room visits, typically around $3,000 per visit in gross charges, represent a critical revenue driver.

Accounts receivable collection times have improved, with Days Revenue Outstanding now at 35 days, better than the 44.5-day standard for a BBB rating. However, as more Medicare beneficiaries shift into Medicare Advantage plans—now about 60% of the Medicare population—claims processing has become more complex. Many denials are now AI-generated, prompting the hospital to focus on documentation accuracy and provider accountability to reduce rejections.

Accounts payable have risen to $27.4 million (from $21.4 million a year ago), another short-term cash-preservation lever that will eventually need to unwind.

The CFO emphasized that capital investment remains far below sustainable levels. Depreciation runs about $16 million per year, but capital spending has been slashed to $5 million in 2025 and $3.2 million in 2026. That imbalance—known as the reinvestment ratio—is manageable for a couple of years but will create a deferred-maintenance issue if not addressed.

The Debt-to-capitalization ratio is now at 36.8% versus a 30% target. This is not because of increased borrow, but instead operating losses decreasing our capital, the denominator in the ratio. With losses reducing equity, access to capital markets will likely remain tight until the hospital demonstrates sustained profitability.

Operational Efficiency: The Next Frontier

The CFO made a point that two key labor productivity measures will determine whether OMC can move from stabilization to profitability. The first, Productive Hours per Adjusted Patient Day, measures how many staff hours it takes to deliver care across inpatient and outpatient services. Lower numbers signal greater efficiency and better use of staffing resources.

The second, Productive Hours per wRVU, focuses on clinic operations. A wRVU, or “work Relative Value Unit,” reflects the intensity and complexity of a provider’s work and is a standard benchmark for physician productivity. This metric shows how efficiently the organization converts staff time into billable activity. The CFO was candid: both metrics “need to get a lot better.” He acknowledged that these “conversations are difficult” for department heads, but insisted that they are necessary if OMC is to regain financial stability.

A Cultural Shift Underway

The interim CEO described a cultural reset rooted in transparency and accountability. Each department now meets monthly to review data, confirm accuracy, and discuss progress on specific performance targets. His mantra—“no more and no less”—summarizes the effort to align staffing levels precisely with patient demand.

He added, “Everything is fair game, so long as patient quality and service don’t suffer.” That philosophy captures the new approach: discipline without austerity, data without detachment. The hospital is moving from anecdote to evidence, from defensive explanations to operational metrics.

Conclusion

I left the meeting with cautious optimism. OMC’s interim leadership is professionalizing the organization, focusing on controllable levers like productivity, scheduling, and billing accuracy rather than fixating on external reimbursement rates. The numbers still show losses, but they also show stabilization—a crucial first step in any turnaround. There are many changes still required to create a long term viable business model. We must move quickly to make that happen. My gut feel is that if we can control costs, while improving productivity to generate $300 million in Patient Revenue (and ~$315 in total operating revenue), we will generate enough cash flow to fund capex, pay suppliers and rebuild our capital. I don’t know if this is probable in 2027, but it seems possible to me.

It bears repeating that many rural hospitals face similar payor mixes and still manage to turn a profit. The difference is execution. OMC’s new leadership seems to understand this, and the early data suggests that financial discipline and cultural accountability are finally taking root. The hospital’s next challenge will be translating these incremental gains into long-term sustainability, but for the first time in several years, that goal feels achievable.

P.S. I am not a healthcare expert, so I would love to hear any feedback - especially on managing Productive Hours per Adjusted Patient Day in the hospital or per wRVU in the clinics. Please message me if you don’t mind educating me a bit.

Charts

Active dialogue and engagement with our readers is crucial. Writers on this platform are encouraged—and expected—to revisit their articles regularly, responding thoughtfully to readers’ questions and concerns.

We want conversations, not shouting matches. Therefore, comments will be reviewed regularly and are expected to adhere to these foundational guidelines:

Stay on Topic: Comments must relate directly to the article.

Respectfulness: Every comment should demonstrate respect toward authors, website management, and fellow commenters. Bullying, name-calling, or disrespectful behaviors will not be tolerated.

Constructive Dialogue: Political grandstanding is unwelcome here. While some discussions naturally involve political elements, the goal is to enhance understanding, clarify perspectives, and contribute constructively.

No Personal Attacks: As Theodore Roosevelt wisely said, it’s the person who is “actually in the arena” who deserves our respect. Criticism is welcome, but personal attacks are not.

Transparency: Any new guidelines needed as this platform evolves will prioritize civility, decency, and productive dialogue.

Thanks, Danny, for sharing my report. I know there are still many challenges ahead, but I hope this analysis helps our community—and OMC employees—better understand the seriousness of the situation. We have to be honest with ourselves: there will be no hospital without a sustainable, long-term business model.

I was frankly stunned to learn that only 2 out of 80 providers are meeting the 50th-percentile productivity benchmark used by similar hospitals. That suggests something very different is happening at OMC. The next hundred days are critical. We need to execute with urgency and discipline—it will define not just OMC’s future, but that of our entire community.